What is the tax treatment of bad debts?.

Part I. Spain.

The impairment of financial assets, including receivables made up of trade receivables (for operations related to the company’s line of business) or receivables from non-trade operations (e.g. loans granted), is a recurrent occurrence in companies.

As is the case with most of the operations of the transfer, the accounting treatment of impairment losses differs from the tax treatment. In this scenario, we will see their treatment in both, starting with Spain and in a second part, in the main Latin American economies.

For accounting purposes, the Spanish General Accounting Plan (PGC) mandates, among others, to consider the principles of accrual and prudence by which transactions are accounted for as they occur; however, in order to provide for credit impairment, the principle of prudence requires that: «(…) all risks (…) must be taken into account as soon as they are known (…)» objectively assessing their impairment by subsequent event(s) that reduce or delay flows which, for trade receivables, can be estimated by global or individual method according to the size of the receivable.

Impairment losses on loans and receivables are recognized in profit and loss (P&L) and, consequently, affect the income statement with an income or an expense for their allocation and reversal, if they occur, respectively.

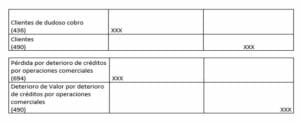

Your accounting to the risk estimation will be, in your individual method:

It is recorded at the closing of the fiscal year if the uncollectibility has become irreversible:

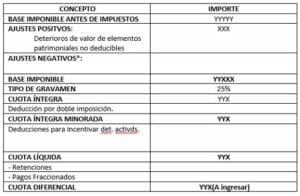

The objectivity with which this accounting recognition is determined differs from what is required for tax purposes causing that, in many cases, both criteria do not coincide, either when we recognize the expense or the reversionary income, having to proceed to the relevant adjustments for the determination of the Taxable Income (BI) of the Corporate Income Tax (IS).

For tax purposes, in accordance with Arts.10, 11 and 13 of the Corporate Income Tax Law (LIS), they can only be recognized when any of the following are met: «Art. 13 a) That the period of 6 months has elapsed since the maturity of the obligation. b) That the debtor is declared bankrupt. c) That the debtor is being prosecuted for the crime of concealment of assets. d) That the obligations have been judicially claimed or are the subject of judicial litigation or arbitration proceedings on the resolution of which their collection depends.«

Therefore, it is not possible to deduct those owed by public law entities, unless their existence or amount is the subject of a lawsuit; those related to related entities; nor those corresponding to global estimates of insolvency risks, except for Reduced Size Companies (ERD).

Consequently, whenever the impairment of a receivable is recognized in the income statement and the legal requirements for its deduction are not met, it must be reversed in the company’s income statement at the end of the year.

The same must occur in the event that the risk is, in turn, reversed for accounting purposes the following year and was not subject to tax recognition; or if the loss is irreversible and should be deducted for tax purposes, but in both cases, as a negative adjustment*.

¿Necesitas asesoramiento legal?

The partners of Lawyou specialized in Business Law and Accounting will be able to solve any doubt you may have. Our lawyers will help you.

We have lawyers with many years of experience who can help you or provide you with more information about the currently applicable legislation and future changes. Do not hesitate to contact us to tell us about your case through our email info@lawyoulegal.com or, if you prefer, you can also call us at 602 226 895.

Ángela Villa Muñoz. Lawyer Chile.

Non-profit collaborator

Comentarios

Comments are closed.